Education is one of the most important investments in life. But for many families, arranging money for higher studies in India or abroad is not easy. This is where the JanSamarth Portal comes in. It is a government platform that connects students with banks and education loan schemes in a simple and transparent way. If you have heard about jansamarth loan apply online and want to know how it works, this blog will explain everything in easy words.

The JanSamarth Portal was launched by the Government of India in June 2022. It is a single digital platform that connects 13 government-linked credit schemes with over 125 lenders, including almost all public sector banks. For students, the biggest advantage is that the portal helps in finding the right education loan without visiting multiple banks or filling out endless paperwork.

What is the JanSamarth Portal?

Imagine the jansamarth portal as an online connection between banks and students. It is meant to assist individuals in applying for loans to finance education, Agriculture loans, business, and housing. In the case of education, the portal has united all the big schemes under a single platform where one can easily compare and apply.

The primary intention of this portal is to make it accessible in order to lessen the paperwork and introduce transparency to loans. Previously, students were required to visit one bank after another; however, with the introduction of jansamarth loan apply online, the entire process takes a couple of clicks. This is not only time-saving, but equal opportunities for higher education can be provided to students of all backgrounds.

JanSamarth Education Loan

When people talk about JanSamarth education loan, they usually mean applying through the portal for one of the available government-backed schemes. These loans cover studies in India as well as abroad. Students can apply for tuition fees, hostel charges, travel expenses, and other study-related costs.

The schemes also provide subsidies on interest rates for students from economically weaker sections, backward classes, and minority groups. This makes education loans more affordable.

Education Loan Schemes Available on JanSamarth

Here is a simple table showing some of the important education loan schemes you can access through the jansamarth portal login.

| Scheme Name | Who Can Apply | Benefits |

| Central Sector Interest Subsidy (CSIS) | Students from families with annual income up to ₹4.5 lakhs | Interest subsidy during moratorium (course period + 1 year) |

| Dr. Ambedkar Central Sector Scheme | OBC and EBC students studying abroad | Interest subsidy during moratorium |

| Padho Pardesh (discontinued for new applications after 2022) | Minority students studying abroad | Interest subsidy during moratorium |

These are just examples. The portal gives access to many other credit-linked schemes, and the student can choose according to eligibility.

Eligibility for JanSamarth Loan

You must meet some basic conditions to apply to jansamarth loan online. You have to be an Indian citizen and must have gained admission in a known institution either in India or elsewhere. The scheme requirement should be equal to your family income. As an illustration, the income of ₹4.5 lakhs a year is needed in CSIS.

There are also some schemes that will require category certificates, such as OBC or minority status. It is thus advisable to confirm the precise eligibility of the scheme of your choice before beginning to enter your jansamarth portal logins.

Documents Required for JanSamarth Loan

When applying for an education loan, keeping the right documents ready is very important. Commonly required papers include Aadhaar card, PAN card, address proof, admission letter from the college, income certificate, and academic records. In most cases, banks also ask for co-borrower documents like income proof of parents or guardians.

If you have these ready before you start the jansamarth loan apply online login, your application process will be much smoother.

How to Apply for JanSamarth Loan Online

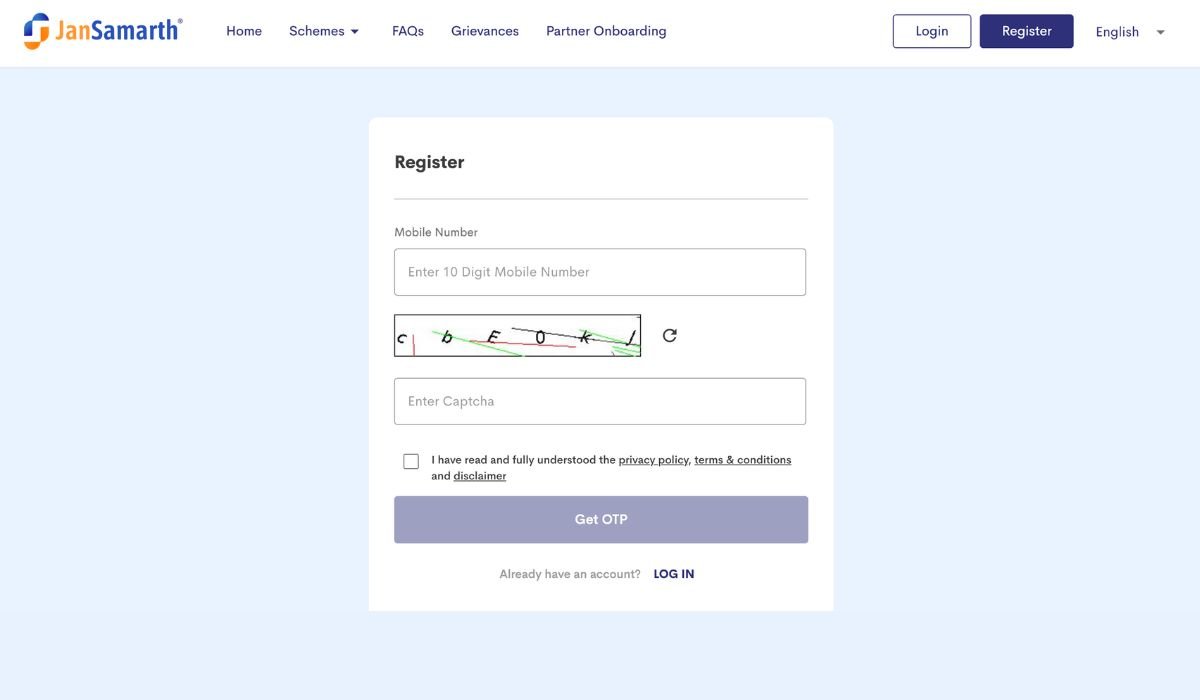

Jansamarth loan apply online is a very simple procedure. You have to visit the official site first and log in to the jansamarth portal. In case you are a first-time user, you must be registered with your information. Upon registration, you will be able to use your credentials.

You can determine your eligibility after entering the portal by answering several questions. The portal will then provide an idea of schemes that you can apply for. You have the option for the scheme to follow: complete the online form and upload your documents. Lastly, you can apply and follow the status on your account.

The most interesting part is that you do not need to visit different banks and stand in line. It is all done over the internet in an open manner.

Checking Application Status

After applying, students are often worried about whether their loan is approved. The jansamarth portal login allows you to track your application in real time. You just have to log in, go to the “My Applications” section, and check the current status. This helps you stay updated without running after banks.

Interest Rates and Repayment

The interest rates on education loans under JanSamarth will be based on the plan and the bank itself. They are typically cheaper than those provided by the private lenders, and subsidies are offered to weaker sections. The repayment typically begins following the moratorium period, i.e., the length of the course, plus one year or six months of employment. The repayment term is not strict and can extend to 15 years of repayment, which relieves the students.

Benefits of JanSamarth Loan

There are many reasons why students prefer jansamarth loan apply online login. First, the process is fully digital, so paperwork is less. Second, multiple government schemes are available on a single platform. Third, interest subsidies reduce the financial burden. Fourth, students can track their status in real time. Overall, it is a transparent and student-friendly system.

Challenges and Solutions

Some students are not fully aware of eligibility rules, so they face rejections. The solution is to carefully read scheme details before applying. Sometimes, there are delays in processing due to incomplete documents. The solution is to upload clear and correct papers. If you face difficulties, you can also contact the helpdesk of the portal for support.

Frequently Asked Questions

Q1: What is the maximum loan amount under JanSamarth education loan?

Most schemes offer up to ₹10 lakhs for studies in India and ₹20 lakhs for studies abroad.

Q2: Do I need collateral for these loans?

Loans up to ₹7.5 lakhs usually don’t need collateral. For higher amounts, banks may ask for property or other assets.

Q3: How long does approval take?

If all documents are correct, approval can come within 1–2 days.

Conclusion

The JanSamarth Portal has transformed how education loans are applied by students in India. It saves time and enhances transparency, as well as reduces paperwork by centralizing various government schemes and lenders. You can apply online and choose the option of jansamarth loan either in India or in a foreign country; this is one of the best options available to get financial assistance towards your education.

Therefore, in case you are either a student or a parent and need support, do not wait. Get to the jansamarth portal login, navigate through the schemes, and start on your dream education.

Also Read About :- iGOT Karmayogi – A Digital Path to Transforming Civil Services